A tool for identification and reporting of tax schemes (MDR)

Get a handle on tax schemes!

Important:

Upcoming deadlines

Deadlines for reporting tax arrangements concerning income taxes of 2019 are approaching.

While regulations on Mandatory Disclosure Rules are in power since the beginning of 2019, the deadline to provide Polish tax authorities with .xml file on tax arrangements concerning income taxes expires in 2020 (depending on type of the tax).

If there has been any tax benefits or actions connected with reportable tax arrangements in 2019, taxpayers are obliged to provide MDR-3 .xml file. The obligation is independent from reporting made during 2019.

The report has to be signed by taxpayer himself (its management).

MDR – what’s that?

About tax schemes

On 1 January 2019, new tax regulations entered into force implementing Council Directive 2018/822/EU, which concerns cross-border reporting of tax schemes under MDR (Mandatory Disclosure Rules). The provisions implementing the Directive into the Polish legal order have significantly expanded the application of the rules on MDR.

The provisions on MDR require due diligence in relations with both tax authorities and all entities involved in a given transaction – both during the preparation phase and in the course of implementation.

When compared with the Directive, the Polish provisions on MDR additionally apply to:

- domestic tax schemes

- all taxes (not only CIT)

- matters not related to tax optimization/ avoidance (such as relief for R&D activities, special economic zones, etc.)

Who does MDR apply to?

Reporting on tax schemes is the responsibility of the promotor, as well as in some cases of those assisting and beneficiaries (enterprises/taxpayers).

Retroactive effects

Reporting is mandatory for tax schemes implemented in 2018:

– cross-border schemes – implemented after 25 June 2018

– domestic schemes – implemented after 1 November 2018.

MDR reporting

For promotors and beneficiaries, the deadline for reporting a tax scheme expires 30 days form the day of the first activity associated with the scheme.

Harsh penalties

The rules on MDR impose harsh penalties for infringements – as much as PLN 21,000,000 for failure to report a scheme, and PLN 2,000,000 for a promotor who lacks a procedure.

MDRnow

is a comprehensive instrument supporting management of risk associated with MDR.

The definition of what constitutes a tax scheme is complicated, and not at all clear. Taking advantage of years of tax consulting experience by the specialists at Olesiński & Wspólnicy, we have created MDRnow, which comprehensively supports the risk management process related to tax schemes and guides the user step by step through the analysis, verification and reporting of tax schemes by generating MDR-1 and MDR-3 files. The application works in both Polish and English language versions.

Operates in a cloud delivered by Amazon Web Services

Data secrecy is guaranteed (mandatory login)

Access from any computer (no installation required)

Allows generation of MDR-1 and MDR-3

MDRnow

is a comprehensive instrument supporting management of risk associated with MDR

The definition of what constitutes a tax scheme is complicated, and not at all clear. Taking advantage of years of tax consulting experience by the specialists at Olesiński&Wspólnicy, we have created MDRnow – software offering comprehensive support in the process of managing risk associated with tax schemes.

Operates in a cloud delivered by Amazon Web Services

Data secrecy is guaranteed (mandatory login)

Access from any computer (no installation required)

Guaranteed high level of security

What are the benefits?

Key functions of MDRnow

- support in the process of identification/exclusion of the reporting scheme - the tool guides the user through an intuitive form, the completion of which results in indicating (based on the data entered) whether a given reconciliation is a tax scheme or not

- if a tax scheme is identified - step-by-step support in fulfilling the tax scheme reporting requirement through intuitive prompts for subsequent actions

- preparing an MDR application (MDR-1 and MDR-3) in XML format ready to be sent to the Head of KAS

- facilitates cooperation in execution of the process, division of tasks and responsibilities

- archive/repository function which records all past reconciliations analysed by the system, giving the user access at any time to the history of reconciliations in the organization

- the application works in both Polish and English language versions

The creators

About us

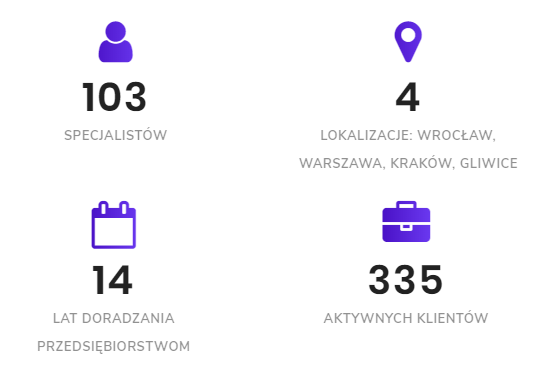

103

specialists

4

locations: Wrocław, Warsaw, Kraków, Gliwice

16

years of experience advising enterprises

335

active clients

O&W Analytics Sp. z o.o.

is a modern consulting company created by the leading consultancy Olesiński & Wspólnicy, specializing in the execution of a broad range of analytical projects.

Initially, the primary service delivered by O&W Analytics was analysis of benchmark data for the purposes of preparing transfer pricing documentation, which was linked with new regulations governing documentation of transactions within capital groups.

With time and with our growing knowledge in the areas of finance, analysis, statistics, accounting and IT, our offer has expanded to make more consulting options available to enterprises.

The skills and experience of the Analytics team are a fantastic complement to those of Olesiński & Wspólnicy, owing to which the two firms often join forces in the execution of projects.

O&W Analytics Sp. z o.o. is a modern consulting company created by the leading consultancy Olesiński&Wspólnicy, specializing in the execution of a broad range of analytical projects.

Initially, the primary service delivered by O&W Analytics was analysis of benchmark data for the purposes of preparing transfer pricing documentation, which was linked with new regulations governing documentation of transactions within capital groups.

With time and with our growing knowledge in the areas of finance, analysis, statistics, accounting and IT, our offer has expanded to make more consulting options available to enterprises.

The skills and experience of the Analytics team are a fantastic complement to those of Olesiński&Wspólnicy, owing to which the two firms often join forces in the execution of projects.

Supporting partner:

Olesiński & Wspólnicy sp.k.

is a modern Polish consulting firm. We specialise in targeted areas of the law and taxes while at the same time possessing a broad and extensive base of knowledge that gives our clients continual access to a team of experienced experts. The best proof of our effectiveness comes in the form of hundreds of important and often innovative projects.

Among the clients of Olesiński & Wspólnicy are international capital groups, listed companies, leaders on the domestic and European markets in the automotive, e-commerce, chemical, textile, food, construction and energy industries, as well as many other business fields.

Partner merytoryczny:

Olesiński & Wspólnicy sp.k. is a modern Polish consulting firm. We specialise in targeted areas of the law and taxes while at the same time possessing a broad and extensive base of knowledge that gives our clients continual access to a team of experienced experts. The best proof of our effectiveness comes in the form of hundreds of important and often innovative projects.

Among the clients of Olesiński&Wspólnicy are international capital groups, listed companies, leaders on the domestic and European markets in the automotive, e-commerce, chemical, textile, food, construction and energy industries, as well as many other business fields.

The experts

Tomasz Gałka

A licensed tax adviser with 20 years of experience advising international companies. Tomasz has been involved in such projects as transformation and merger of companies, tax planning of the sale of enterprises and significant assets, tax audits and due diligence, representation of clients in proceedings before tax authorities and administrative courts. He handles digitization of tax settlements and participates in the design and implementation of software supporting tax settlements.

Wojciech Fryze

An attorney and member of the District Bar Council in Wrocław, specializing in tax law, particularly in matters related to income taxes. Over the last 10 years, Wojciech has gained experience in advising large enterprises as well as individual investors and entrepreneurs. His rich background includes numerous restructuring projects, due diligence and tax audits and proceedings. He is a co-author of the IT solutions offered by the O&W group, including a tool used in analysis of SAFT-T VAT (Standard Audit File for Tax).

A licensed tax adviser with 20 years of experience advising international companies. Tomasz has been involved in such projects as transformation and merger of companies, tax planning of the sale of enterprises and significant assets, tax audits and due diligence, representation of clients in proceedings before tax authorities and administrative courts. He handles digitization of tax settlements and participates in the design and implementation of software supporting tax settlements.

An attorney and member of the District Bar Council in Wrocław, specializing in tax law, particularly in matters related to income taxes. Over the last 10 years, Wojciech has gained experience in advising large enterprises as well as individual investors and entrepreneurs. His rich background includes numerous restructuring projects, due diligence and tax audits and proceedings. He is a co-author of the IT solutions offered by the O&W group, including a tool used in analysis of SAFT-T VAT (Standard Audit File for Tax).

Contact us to discuss obtaining access to our solution

Contact

Are you interested in receiving the latest news on law and taxes? Sign up for our newsletter.

O&W Analytics Sp. z o.o. is the administrator of personal data. Depending on the relationship between us, the administrator may also be another company from the OW Group. More information can be found here.

MDRnow tool. Copyright © 2023 O&W Analytics Sp. z o.o. All rights reserved

Email:

Phone:

+48 728 403 393

Address:

O&W Analytics Sp. z o.o.

Arkady Wrocławskie

ul. Powstańców Śląskich 2-4

53-333 Wrocław

Email:

Phone:

+48 728 403 393

Address:

O&W Analytics Sp. z o.o.

Arkady Wrocławskie

ul. Powstańców Śląskich 2-4

53-333 Wrocław

Contact form:

Are you interested in receiving the latest news on law and taxes? Sign up for our newsletter.

O&W Analytics Sp. z o.o. is the administrator of personal data. Depending on the relationship between us, the administrator may also be another company from the O&W Group. More information can be found here.

MDRnow tool. Copyright © 2023 O&W Analytics Sp. z o.o. All rights reserved